rsu tax rate us

Vesting after Medicare Surtax max. A app to help calculate how much tax you pay on RSUs.

Rsu Taxes Explained 4 Tax Strategies For 2022

This rate is 238 20 plus the 38 tax on net investment income for high-earning taxpayers.

. Sell Vests assumes you sell immediately upon vesting shares while Hold All assumes you keep your granted shares. So its up to you to select a percentage from the dropdown. For people working in California the total tax withholding on your RSUs are actually around 40.

Check out our new Podcast EpisodeVideo De RSUs Restricted Stock Units. Unlike the much more complicated ESPP they get taxed the same way as your income. Vesting after making over 200k single 250k jointly.

No RSUs are not taxed twice. What about tax withholding on my RSU income. Vesting after making over 137700.

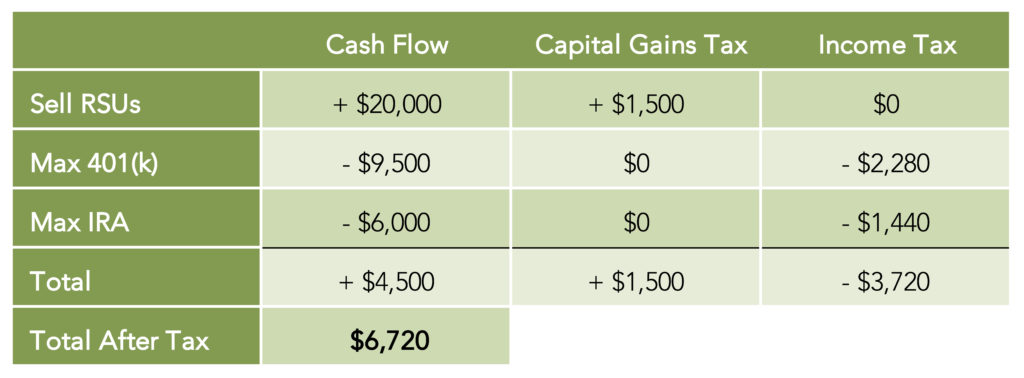

The 22 doesnt include state income Social Security and Medicare tax withholding. RSUs are taxed just like if you received a cash bonus on the vesting date and used that money to buy your companys stock. RSU and Capital Gain Tax rates.

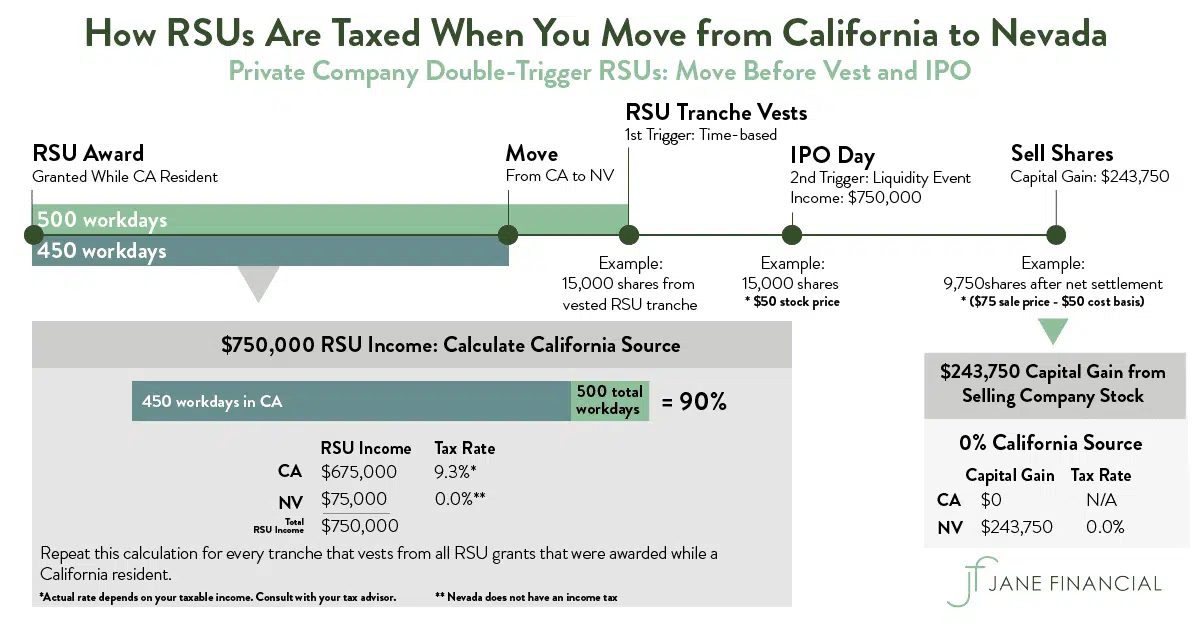

You wont pay tax until you truly own your shares outright. Employer Withholding reporting Tax withholding and reporting are required upon grant for restricted stock and upon vesting of RSUs. Weve capped the state income tax rates at 15.

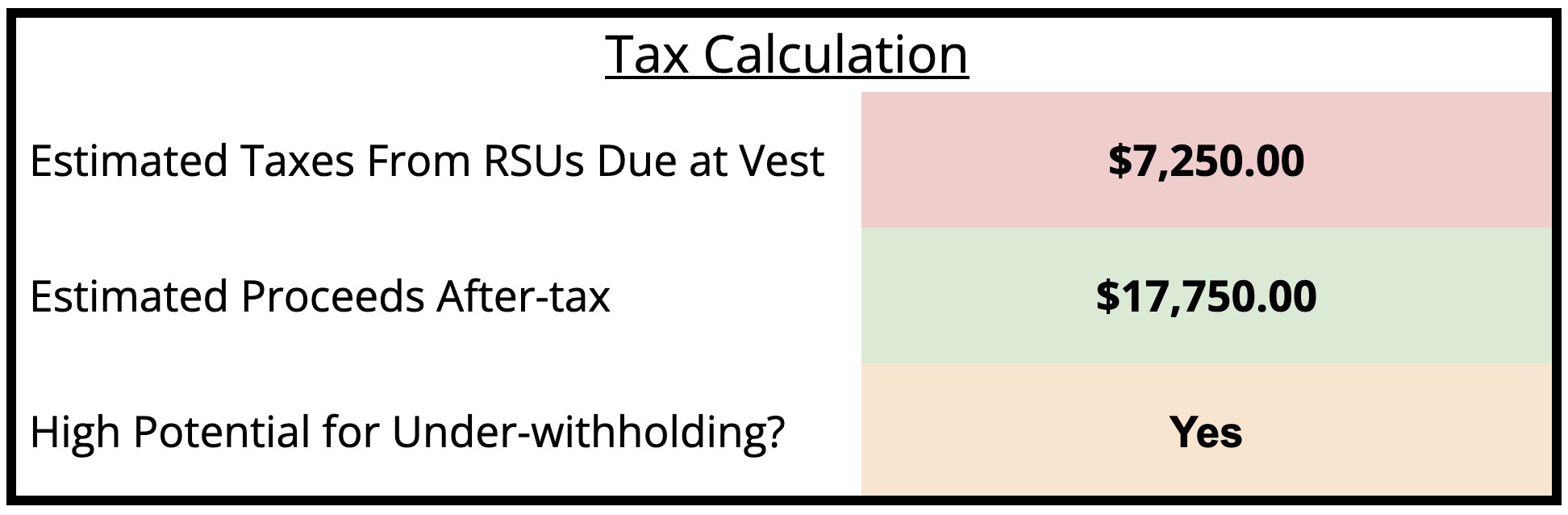

Will RSU income appear on my W-2. Long-term capital gains tax on gain if held for 1 year past vesting. Most companies dont withhold taxes according to your W-4 rate but will instead use the flat IRS rate for supplemental wage income.

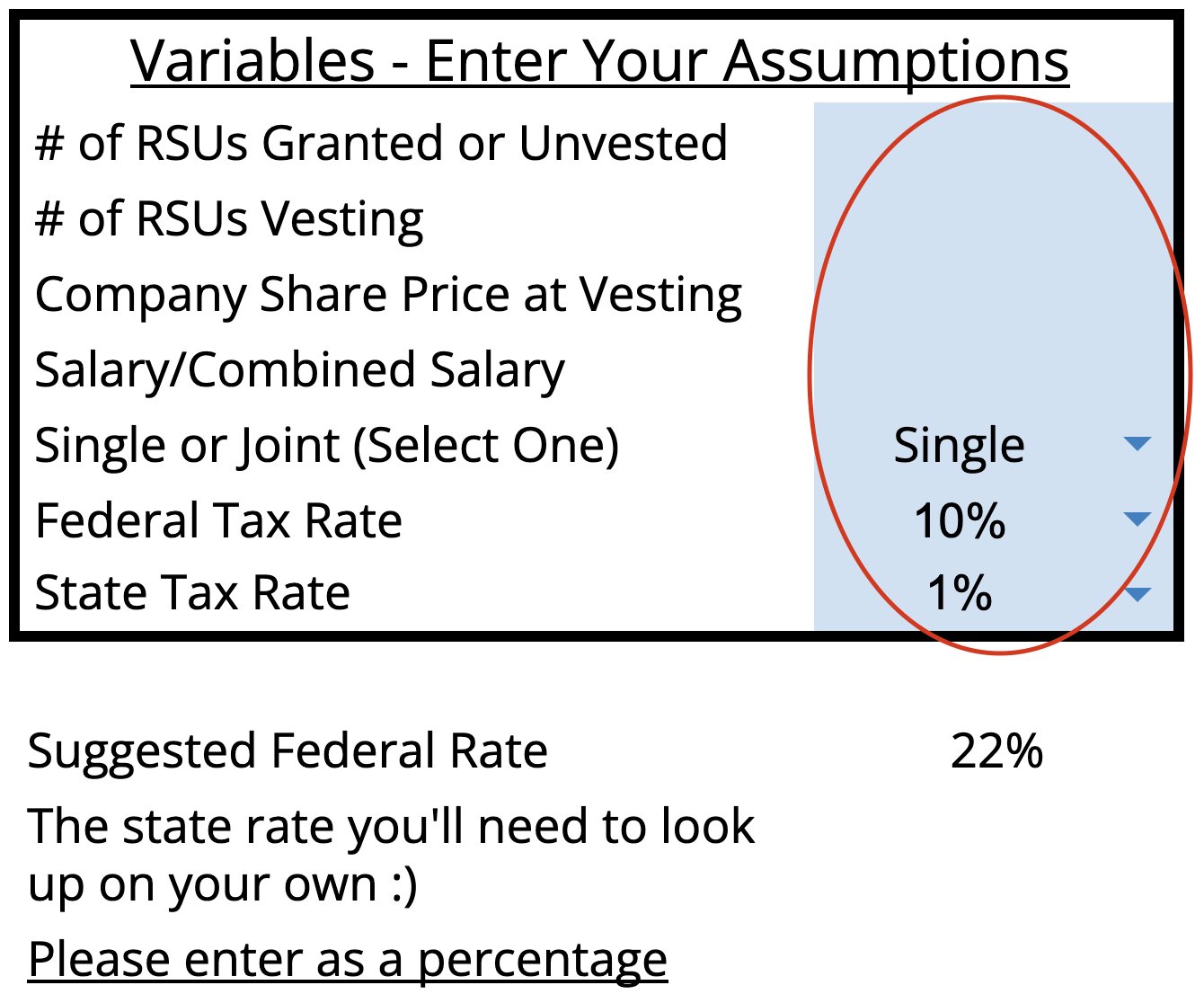

Tax at vesting date is. For your state tax rate itd be a little much for us to pull each states income tax and include it. RSUs are taxed as W-2 income subject to federal and employment tax Social Security and Medicare and any state and local tax.

Input your current marginal tax rate on vesting RSUs. Vesting after Social Security max. RSU and Capital Gain Tax rates.

For 2022 that rate is 22 on supplemental wages up to 1 million and 37 for wages in excess of 1 million. RSUs are taxed at the ordinary income tax rate when they are issued to an employee after they vest and you own them. Many companies withhold federal income taxes on RSUs at a flat rate of 22 37 for amount over 1 million.

On the other hand the rate for short term gains is the same as that for earned income which is 37 for high-income taxpayers. Heres the tax summary for RSUs. Basic Info for RSU Calculator Shares Granted Vesting Schedule Hypothetical Future Value Per Share Marginal Federal Tax Rate You can use the 2020 brackets below to estimate your tax bracket Marginal State Tax Rate Want more RSU info.

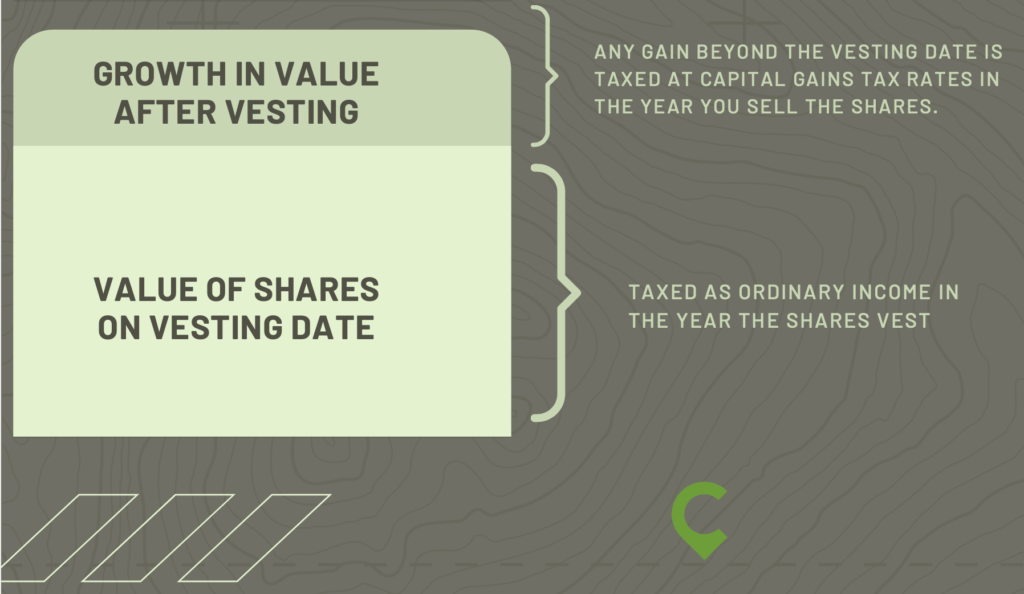

Your RSU income is taxed only when you become fully vested in your shares. Lets say you are granted 200 RSUs on 3112 14From your OP these will vest become yours in equal instalments over the next four anniversary dates -so 50 shares on 3112 15then 50 shares on 3112 16 etc. This means that in addition to paying the normal 40 tax you also pay an additional 20 tax on income that was previously tax-free resulting in a total tax rate of 60 You can avoid paying this 60 tax charge by making a pension contribution.

Ordinary tax on current share value. A big note here you must enter a value even if the value is 0. Single GST rate for all lotteries - 28 Decoding Audit provision us 44AB amended by Budget 2020 New tax audit limit.

Step 5 - Review Outputs of RSU Tax Calculator. The employee is subject to a flat tax of 15 percent on any net gain resulting from the sale of the shares by Argentine Tax residents or alternatively 135 percent on the gross sale price by non-residents. Short-term capital gains tax ordinary income tax rates otherwise this includes immediate sale caution When you receive your shares you are taxed on.

RSU Tax Rate The beauty of RSUs is in the simplicity of the way they get taxed. The RSUs are subject to NI and income tax at your marginal rate on their value at the time they vestYou can either choose to pay the tax. Restricted stock units RSUs are a way for companies to incentivize employees with company stock as part of their compensationthe carrot approach.

Remember that an RSU is technically nothing more than a promise that you will receive stock in the future and the IRS doesnt tax promises. However it can seem like RSUs are taxed twice if you hold onto the stock and it increases in value before you sell it. Decide on your strategy.

Long-term are capital items like RSUs that are held for more than one year after they were grantedobtained. Heres how Restricted Stock Units work. Many employers though make it far less convenient for the employee by withholding on supplemental income like RSUs and bonuses at a flat rate which includes.

Estimate how much your RSU value will increase per year. Of shares vesting x price of shares Income taxed in the current year. Listed in the US He will not be able to recover the taxes he paid as a result of his election A 0 long-term capital gains tax rate applies to individuals in the two lowest 10.

22 for federal taxes 37 if total income is more than 1million Social Security and Medicare and Some amount for state income taxes if you live in a state that has an income tax.

Rsu Taxes Explained 4 Tax Strategies For 2022

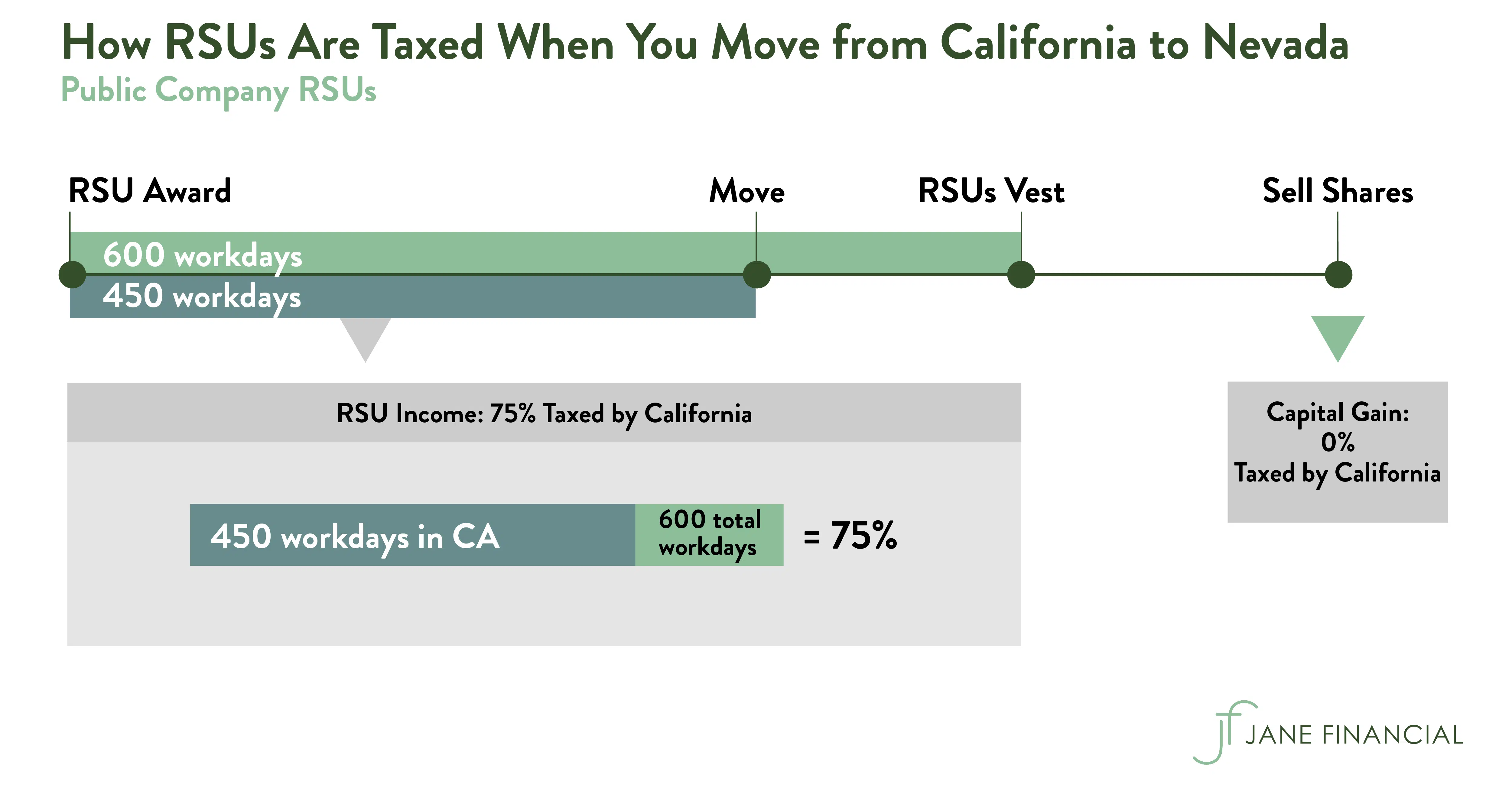

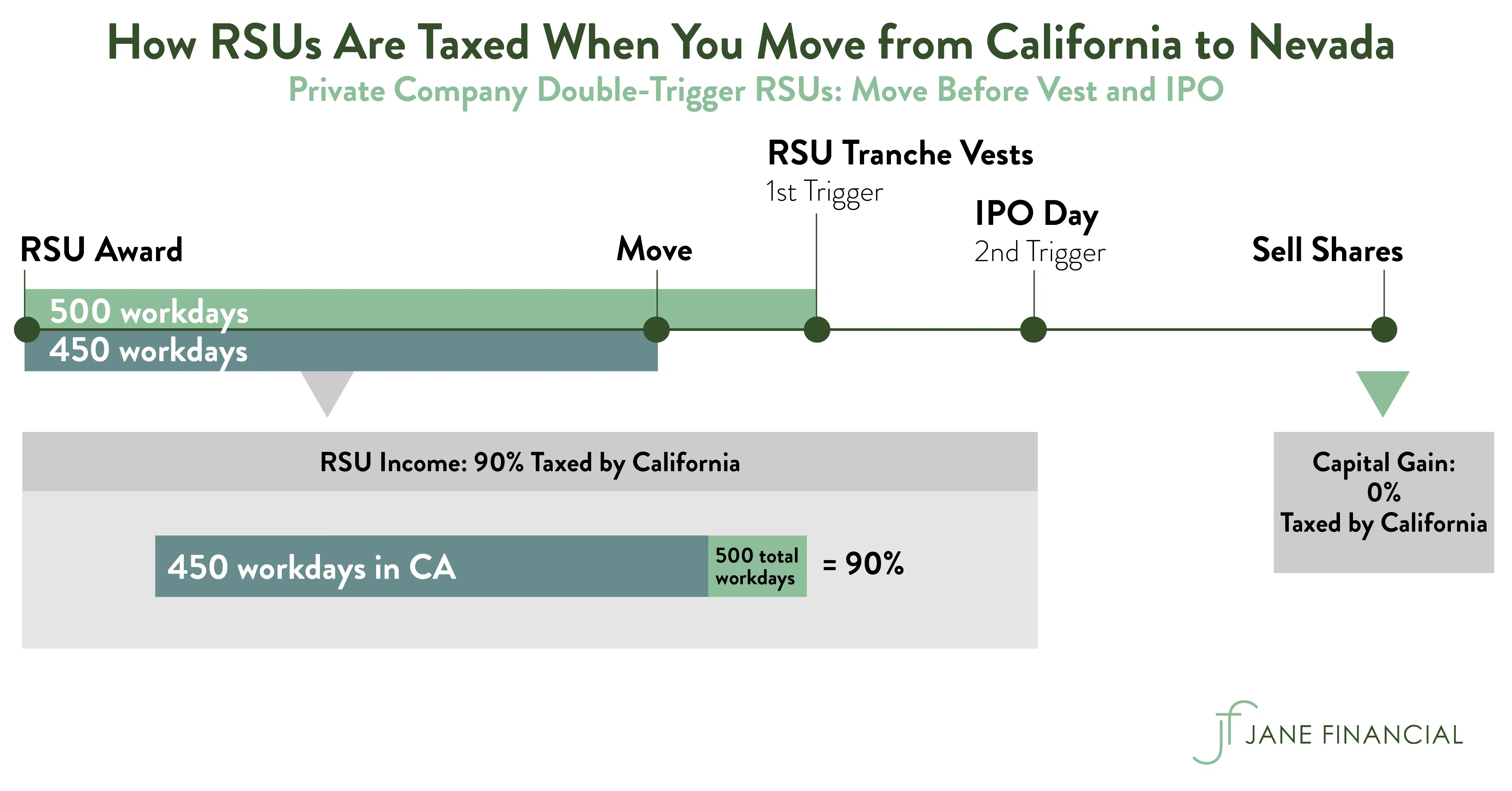

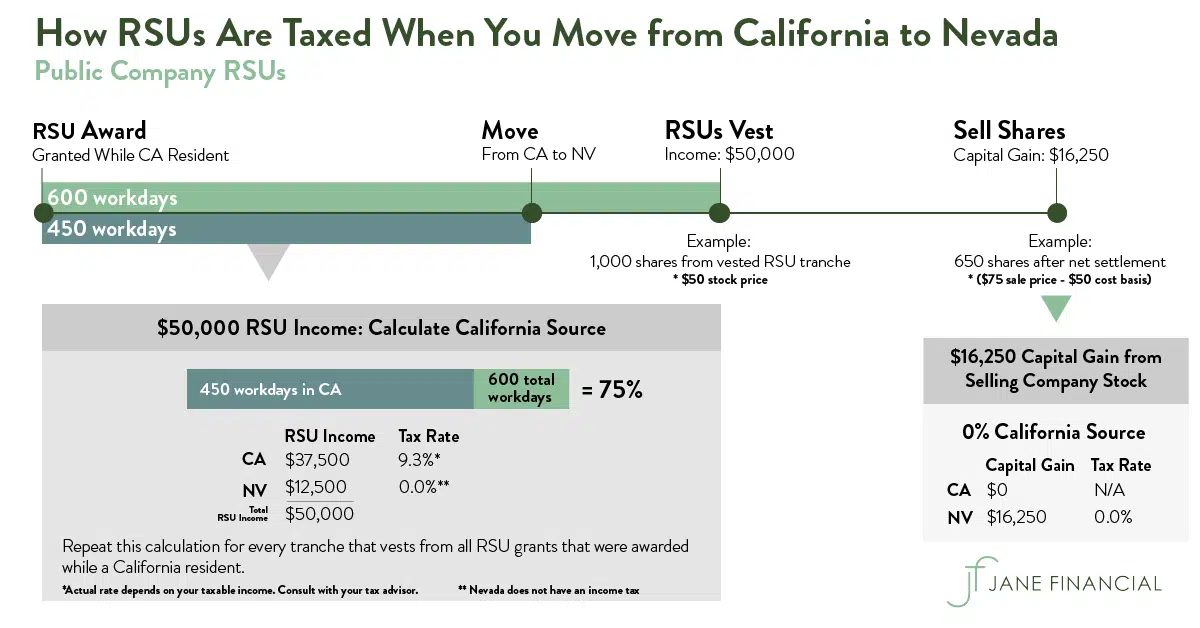

Restricted Stock Units Jane Financial

Rsu Taxes Explained 4 Tax Strategies For 2022

Restricted Stock Unit Rsu Tax Calculator Equity Ftw

Rsu Taxes Explained 4 Tax Strategies For 2022

Rsu Tax Rate Is Exactly The Same As Your Paycheck

Restricted Stock Units Jane Financial

Rsu Taxes Explained 4 Tax Strategies For 2022

I Have Rsus But Didn T Sell Any Why Is My Tax Bill So Crazy Mana

Restricted Stock Unit Rsu Tax Calculator Equity Ftw

Restricted Stock Units Jane Financial

Rsus Restricted Stock Units Essential Facts Capital Gains Tax Key Dates How To Apply

Restricted Stock Units Jane Financial

Restricted Stock Awards Rsas Vs Restricted Stock Units Rsus Carta Capital Gains Tax Salary Requirements Types Of Taxes

Restricted Stock Unit Rsu Tax Calculator Equity Ftw

Restricted Stock Awards Rsas Vs Restricted Stock Units Rsus Carta Capital Gains Tax Salary Requirements Types Of Taxes

Restricted Stock Units Jane Financial

Are Rsus Taxed Twice Original Post Link By Charlie Evans Medium

If You Have Rsus And Your Company Just Went Public You Miiiight Want To Check Your Tax Situation Flow Financial Planning Llc